Climate tech is showing strong growth as an emerging asset class globally, but the Central and Eastern Europe (CEE) has only attracted less than one percent of global investments. A new report by PwC, in partnership with Wolves Summit, presents a first look of its kind at the state of climate tech investment in 27 countries across the CEE region.

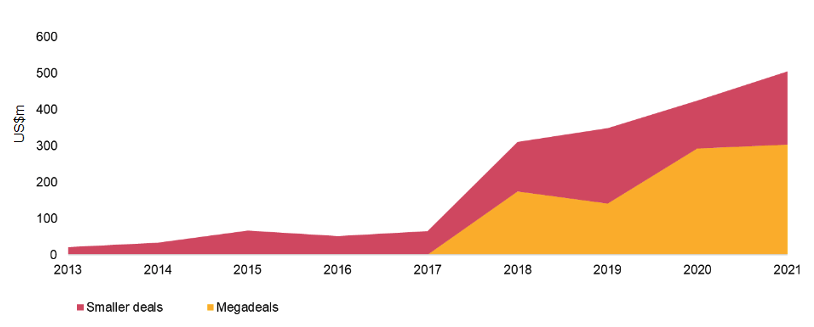

The report shows that climate tech investments in CEE have risen from US$10.6m in 2013 to US$398m in 2020, and to over US$502m in the first half of 2021 alone. While more than US$1.76 bn has been invested in climate tech in CEE between 2013 and the first half of 2021, the report suggests that investments are heavily concentrated in specific areas and that there are further opportunities for growth and diversification in the region.

The climate tech investment landscape in CEE

The study finds that climate tech investments are showing steady growth with more than US$1.76 billion invested between 2013 and the first half of 2021. This growth is mainly driven by the rise of mega deals (deals valued at more than USD $100m) in sectors such as Mobility and Transportation and Industry, Manufacturing and Resource Management.

The CEE region as a whole only contributes to approximately 3.73% of global GHG emissions. At the same time, the region’s share of global climate tech investment is only 0.79% of the total. Given many countries in CEE are showing positive economic growth it is crucial to ensure more funding flows to scaling up decarbonization technologies in the region.

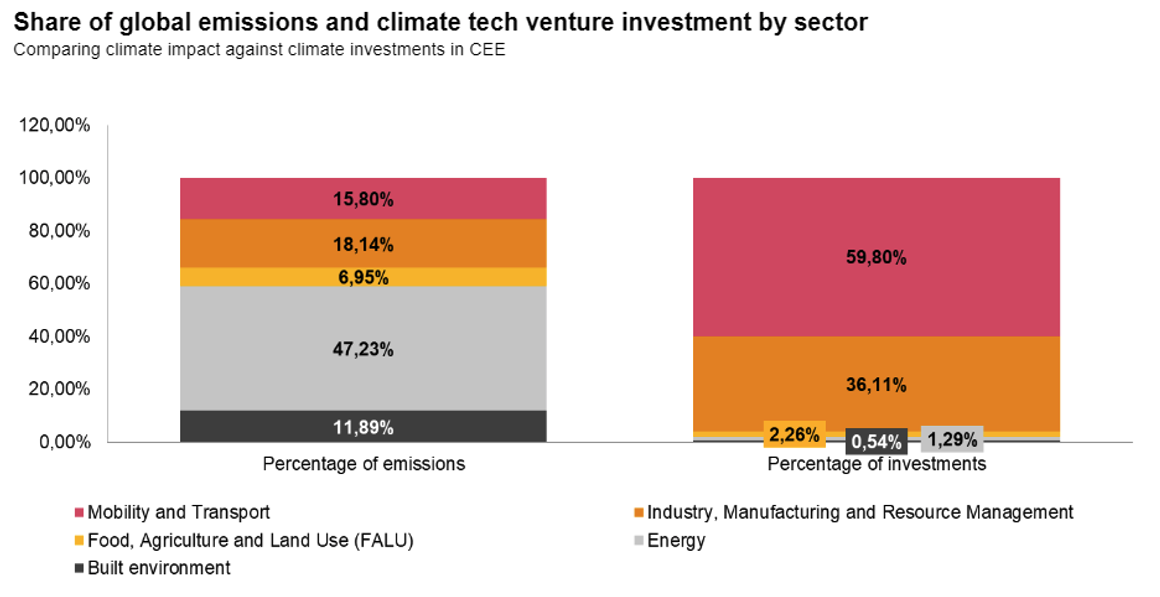

Climate tech investments in CEE are heavily concentrated in the Mobility and Transport sector (59.8%), and in Estonia and Lithuania-based start-ups (74.8%). Tallinn (Estonia), Vilnius (Lithuania), and Sveta Nedelja (Croatia) are the top three most active climate tech investment hubs.

The report also presents interesting insights into the most underfunded areas. Most notably, between 2013 and first half of 2021 CEE start-ups in the Food, Agriculture and Land Use sector attracted just 2.26% of total funding, and those in the Energy sector a mere 1.29%. Although Poland has the largest economy in the region, and it serves as a strategic hub for some industries, start-ups in Poland only raised 4.65% of total CEE climate tech funding.

“In Central and Eastern Europe, sustainability goals have also become security goals. We have even more motivation to work toward the goals set out by the European Green Deal: reducing CO2 emissions by at least 55% by 2030, and achieving climate neutrality by 2050. Net zero obligations and the need for energy independence and security will not be met by business as usual. One of the most exciting ways of making progress is to scale up the impact of climate tech solutions – and to match investor funding with climate tech entrepreneurs,” said Agnieszka Gajewska, ESG Leader at PwC CEE.

CEE Net Zero Future50 start-ups

In addition to showcasing in-depth insights on VC investment data, the report also features a selection of 50 climate tech start-ups based in CEE. Leveraging the Wolves Summit community of 8,000+ start-ups and 3,700+ investors across Europe, PwC and Wolves Summit identified over 170+ start-ups and invited them to present an application for potential inclusion in the report.

PwC ESG professionals in Warsaw then assessed the applicants against a range of indicators across 3 categories (maturity stage, scalability, climate impact), and shortlisted 50 climate tech start-ups for inclusion in the report.

Twelve countries are represented in this cohort of 50 start-ups, with most represented countries being Poland (14) and Estonia (13). In terms of sector, the most represented were Food, Agriculture and Land Use (12), followed by Energy (10), Built Environment (9), and Industry, Manufacturing and Resource Management (9).

Looking at the average start-up profile, it is clear that most are in the early stages of their journey. Only 20% of start-ups have secured Series A/B funding. The remaining 80% is either bootstrapped or operating off of seed funding or grants. Interestingly, 40% of the Future50 start-ups report to have limited understanding of their technologies’ emission reduction potential.

“Start-ups should consider implementing early-on impact assessment methodologies to support their value proposition. Investors are increasingly expecting to know their portco’s climate impact and this area should not be overlooked to secure future funding and stakeholder support,” said José Miguel Salazar Hernández, ESG Hub Manager at PwC CEE.

The new report’s analysis suggests that the climate tech ecosystem in CEE is in its early days, especially when compared with more developed climate tech hubs – or other start-up hubs in general. The findings suggest that currently the right class of investor for the overall climate tech ecosystem in CEE are early-stage venture capitalists who are actively seeking to invest in pre-seed, seed, growth, and early stage companies.

“Historically, founders in CEE lacked the networks, funding and connections that entrepreneurs in Western Europe and the US could otherwise easily tap into . We are now starting to witness more specialised accelerator programs and impact funds designed to speed up the maturation of climate tech start-ups in this region. It’s clear that the best days for Central Eastern Europe remain ahead of us,” said Michael Chaffe, CEO of Wolves Summit.

The Net Zero Future50 report – CEE edition is out on Thursday, 20 October 2022 and can be downloaded from PwC’s website.

Source: PwC Press Release

Date of first publication: 20 October 2022